Temporary Account Definition, vs Permanent, Example

-

Author by

Kashuf Huda

-

Reviewed By

Kashuf Huda

- Last Edited : January 1, 1970

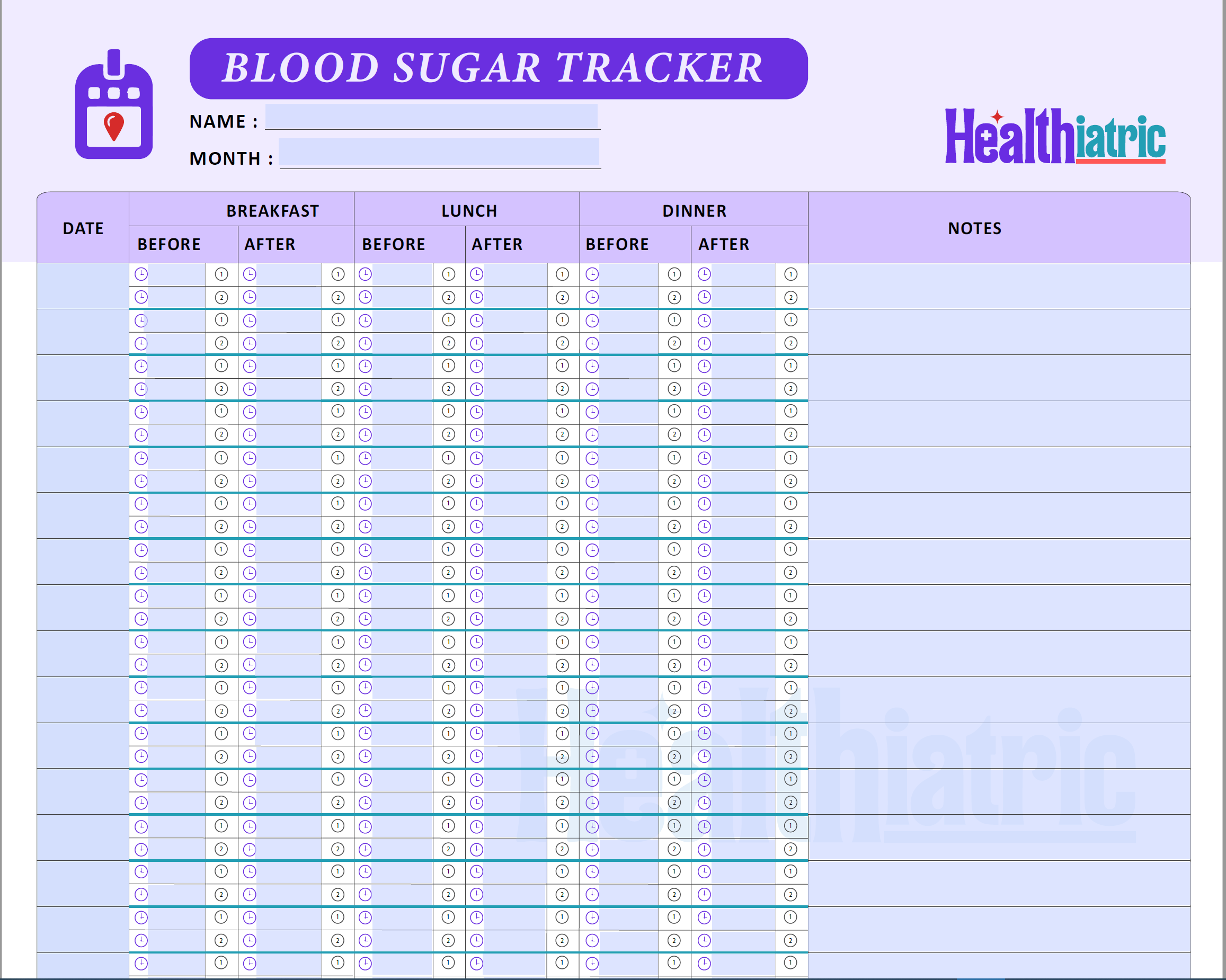

This procedure is necessary todetermine a periodic net income (or loss) and prepare books for thenext period. Yes, temporary accounts play a crucial role in tax calculations. By accurately tracking revenues and expenses, you can determine taxable income and fulfill tax obligations. The bottom line of these accounts is net profit (or loss) at the end of each accounting period. Once this amount is carried forward to the balance sheet, the ending balances of all temporary accounts become nil.

Close all expense and loss accounts

The accountant knows there’s something wrong with these numbers since they are abnormally high. Basically, to close a temporary account is to close all accounts under the category. The accountant then needs to make a debit of $5,000 from the drawings account and a credit of the same amount to the capital account. what do the balances of temporary accounts show? Now for this step, we need to get the balance of the Income Summary account.

What accounts will not be closed to income summary?

Accounts that will not be closed to the income summary include permanent or real accounts, such as assets, liabilities, and equity accounts. These accounts carry their balances into the next accounting period and are not reset to zero. In contrast, temporary or nominal accounts, like revenues and expenses, are closed to the income summary to prepare for the new accounting period. During the closing procedure, temporary accounts are closed to prepare them for balance sheet the next accounting period.

Expense accounts

It shows the net effect of profit and losses incurred by an entity. Temporary accounts belong to the income statement of an entity. The bottom line of the income statement is then shifted to the retained earnings or capital account on the balance sheet depending on the type of entity. Since these temporary accounts were not closed, all of their balances accumulated over the 2022 financial year got carried over to the financial year 2023. The report generated actually shows all transactions from 1 January 2022 to 31 March 2023. The main purpose of temporary accounts is to make sure activities from different periods are not mixed together which would be an overstatement of profits.

- Essentially, it resets for the next period and updates retained earnings with the latest net income or loss.

- However, its ending balance is transferred to the capital account at the end of each accounting cycle as well.

- They rely on temporary accounts, which are reset after fulfilling their role.

- The income summary is a temporary account used to make closing entries.

- Understand the role of temporary accounts in tracking periodic financial performance and their crucial place in the accounting cycle.

As mentioned, temporary Travel Agency Accounting accounts in the general ledger consist of income statement accounts such as sales or expense accounts. When the income statement is published at the end of the year, the balances of these accounts are transferred to the income summary, which is also a temporary account. The purpose of closing entries is to prepare the temporary accounts for the next accounting period. In other words, the income and expense accounts are “restarted”.

Step 2: Close all expense accounts to Income Summary

- After the other two accounts are closed, the net income is reflected.

- These accounts are closed directly to retained earnings by recording a credit to the dividend account and a debit to retained earnings.

- Then, the ledger balances are adjusted for corrections and reconciled.

- The balances are transferred to the retained earnings account in the equity section of the balance sheet.

- Whether dealing with assets or expenses, the first steps are the same.

- Revenue and expenses are crucial for understanding a company’s profitability.

- It means these accounts begin with zero account balances as well.

The adjusted balances are then carried forward to either temporary accounts on the income statement or permanent accounts on the balance sheet. This alignment is crucial because it affects the timing of tax deductions and the recognition of income, which can have a substantial impact on the amount of tax owed. When preparing taxes, temporary accounts take on a significant role, as they are the primary source for reporting a company’s taxable income. Throughout the fiscal year, these accounts accumulate transactions that will ultimately influence the tax liability of a business. Revenue and expense accounts, in particular, are scrutinized to determine the net income, which forms the basis of income tax calculations. At the end of a financial period, all transactions from the revenue accounts and expense accounts are transferred to the income summary account as shown above.

Kashuf Huda

Kashuf is an amateur storyteller and inspiring copywriter. Hooked on eading classical and contemporary literature and loves to draw parallels between fiction and current social phenomena. Her keen interest in health and wellness problems particularly related to women has got her to set forth to explore, critique, and try solving the enigma. When not writing she can be found baking, watching tv shows, and napping. Notorious among friends for her humor. Sucker for good gossip. Graduated in English literature, she can be good company over a cup of coffee but promise you will talk about books.

You Might Also Like

-

Hania Ashfaq Min

Discover the Enjoyment of Free Dime Slot Machine Online

-

Hania Ashfaq Min

The Ultimate Overview to Free Spin Online: Everything You Need to Know

-

Hania Ashfaq Min

Benefit Free Rotates: A Guide to Optimizing Your Gambling Establishment Experience

-

Kashuf Huda Min

The Ultimate Guide to Slots Online Free

-

Hania Ashfaq Min

Programa de Referencia de Préstamos Personales Individuales: Una Guía Comprehensiva