irs announces 2021 mileage rates for business medical and moving 4

-

Author by

Hania Ashfaq

-

Reviewed By

Hania Ashfaq

- Last Edited : January 1, 1970

IRS Announces the 2021 Standard Mileage Rate

The information provided on this website does not, and is not intended to, constitute legal, tax or accounting advice or recommendations. All information prepared on this site is for informational purposes only, and should not be relied on for legal, tax or accounting advice. You should consult your own legal, tax or accounting advisors before engaging in any transaction. The content on this website is provided “as is;” no representations are made that the content is error-free.

Further reading: 2024 GSA Mileage Reimbursement Rates: Update on Government Mileage Rates

Proposed §1.865-3(d)(2)(ii) provides the books and records method that a taxpayer can elect to apply in lieu of the default 50/50 method, including the rules for making that election and the records that must be provided to the Commissioner upon request. To the extent income from either type of inventory sale is treated as U.S. source under proposed §1.865-3(d)(2) or (3), the income will generally be effectively connected with the conduct of a U.S. trade or business under section 864(c)(3). This document contains proposed regulations modifying the rules for determining the source of income from sales of inventory produced within the United States and sold without the United States or vice versa. These proposed regulations also contain new rules for determining the source of income from sales of personal property (including inventory) by nonresidents that are attributable to an office or other fixed place of business that the nonresident maintains in the United States. Finally, these proposed regulations modify certain rules for determining whether foreign source income is effectively connected with the conduct of a trade or business within the United States. On December 17, 2021, the IRS announced it’s annual optional standard mileage rate for 2022.

Flat Vehicle Allowance

See, e.g., Watt v. Alaska, 451 U.S. 259, 267 (1981) (statutes should be read to give effect to each if it can be done so while preserving their sense and purpose). WASHINGTON — The Internal Revenue Service today announced an increase in the optional standard mileage rate for the final 6 months of 2022. Taxpayers may use the optional standard mileage rates to calculate the deductible costs of operating an automobile for business and certain other purposes.

LLC vs S Corp vs C Corp: Pros, Cons, and Tax Benefits Explained

Pursuant to section 7805(f), this notice of proposed rulemaking has been submitted to the Chief Counsel for Advocacy of the Small Business Administration for comment on its impact on small businesses. Rulings and procedures reported in the Bulletin do not have the force and effect of Treasury Department Regulations, but they may be used as precedents. Unpublished rulings will not be relied on, used, or cited as precedents by Service personnel in the disposition of other cases. In applying published rulings and procedures, the effect of subsequent legislation, regulations, court decisions, rulings, and procedures must be considered, and Service personnel and others concerned are cautioned against reaching the same conclusions in other cases unless the facts and circumstances are substantially the same.

standard mileage rates decrease

Taxpayers always have the option of calculating the actual costs of using their vehicle rather than using the standard mileage rates. Also, you can’t deduct repair and maintenance costs, depreciation, registration fees, tires or insurance. 14 cents per mile driven in service of charitable organizations, the rate is set by statute and remains unchanged from 2020.

- 14 cents per mile driven in service of charitable organizations, the rate is set by statute and remains unchanged from 2020.

- Finally, these proposed regulations modify certain rules for determining whether foreign source income is effectively connected with the conduct of a trade or business within the United States.

- This figure is set by law, which means it does not adjust along with other mileage rates.

- As of January 1, 2021, the IRS lowered standard mileage rates by 1.5 cents, largely due to the pandemic and decreased driving costs.

Part III

Under paragraph (b)(2) of this section, $80 of gross receipts will be allocated to sources without the United States, and the remaining $20 of gross receipts will be allocated to sources within the United States. These proposed regulations do not have federalism implications and do not impose substantial direct compliance costs on state and local governments or preempt state law within the meaning of the Executive Order. These proposed regulations do not include any Federal mandate that may result in expenditures by state, local, or tribal governments, or by the private sector in excess of that threshold. Although the Act amended section 863(b), it made no changes to section 865(e)(2), which does not explicitly reference or depend upon section 863. The 2018 Blue Book notes the absence of any change to section 865(e)(2).

- Though mileage deduction remains optional in most U.S. states, there are some that mandate mileage tax breaks in 2021.

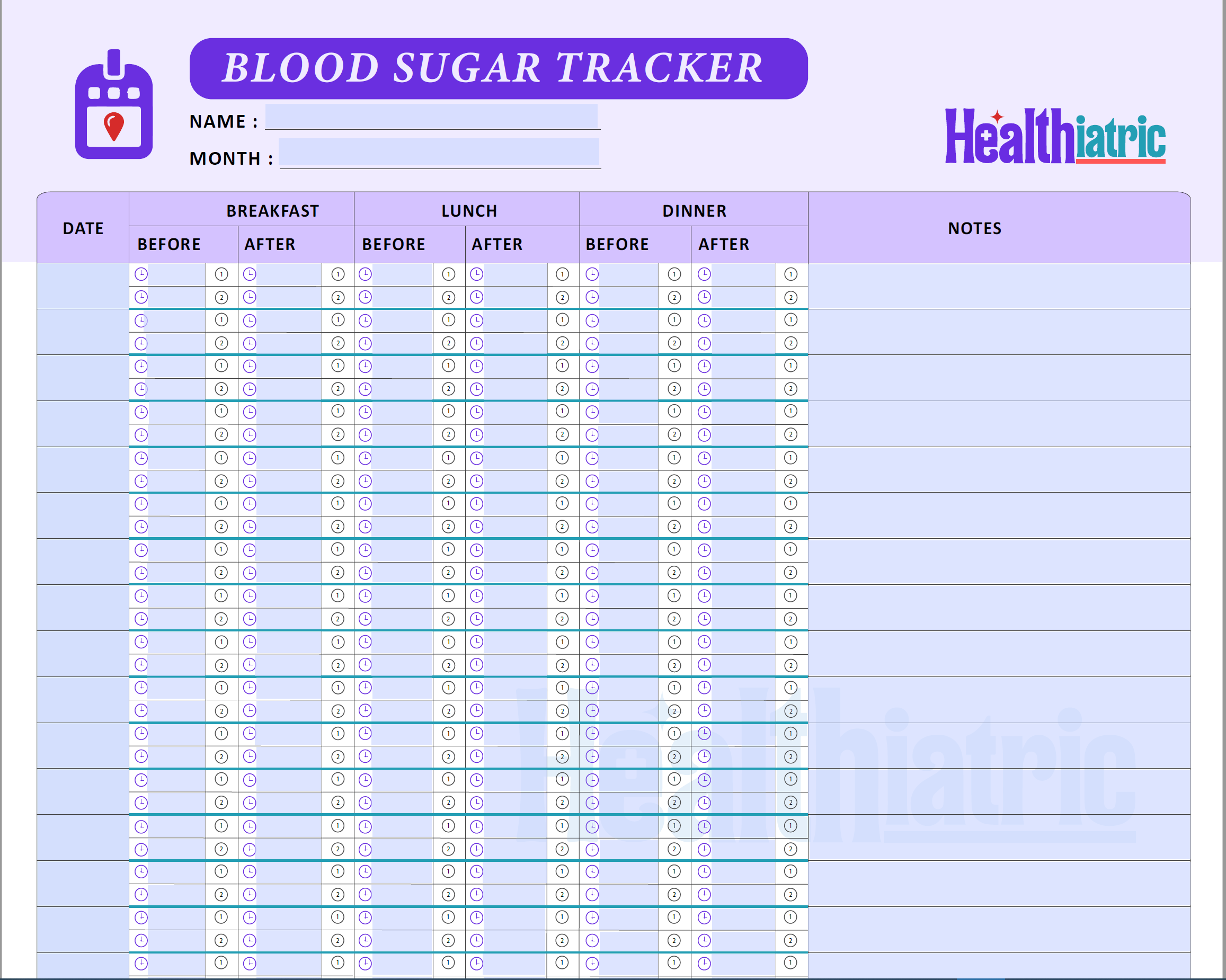

- In 2021, the standard IRS mileage rate is 56 cents per mile for business miles driven, 14 cents per mile for charity miles driven and 16 cents per mile for moving or medical purposes.

- Under paragraph (b)(2) of this section, $80 of gross receipts will be allocated to sources without the United States, and the remaining $20 of gross receipts will be allocated to sources within the United States.

The standard mileage rate is used to calculate the deductible costs of operating an automobile for business, charitable, medical or moving purposes. The standard mileage rate for business use is based on an annual study of the fixed and variable costs of operating an automobile. Absent a change to the rules of current §1.863-3(c)(1)(ii)(B), the Act’s modifications to the depreciation treatment of U.S. production assets will have the unintended effect of skewing the apportionment formula in favor of foreign source income because non-U.S.

Revoked describes situations where the position in the previously published ruling is not correct and the correct position is being stated in a new ruling. Distinguished describes a situation where a ruling mentions a previously published ruling and points out an essential difference between them. Clarified is used in those instances where the language in a prior ruling is being made clear because the language has caused, or may cause, some confusion. Redesignating paragraph (h) as (g) and revising newly redesignated paragraph (g). In newly designated paragraph (c)(4)(iii), redesignating paragraphs (c)(4)(iii)(i) and (ii) as paragraphs (c)(4)(iii)(A) and (B).

Where applicable, section 865(e)(2) applies “notwithstanding any other provisions” of subchapter N, part I, including sections 863(b), 861(a)(6), and 862(a)(6). Under the Tax Cuts and Jobs Act of 2017, taxpayers cannot claim a miscellaneous itemized deduction for unreimbursed employee travel expenses. The 2024 IRS mileage rates have been irs announces 2021 mileage rates for business medical and moving set at 67 cents per mile to accommodate the economic changes over the past year.

The optional business standard mileage rate is used to compute the deductible costs of operating an automobile for business use in lieu of tracking actual costs. This rate is also used as a benchmark by the federal government and many businesses to reimburse their employees for mileage. As we approach the new year, understanding the changes in the 2024 IRS mileage rates becomes crucial for both individuals and businesses. The IRS standard mileage rates are vital tools for calculating deductions for the use of a vehicle for business, charitable, medical, or moving purposes.

The Internal Revenue Service (IRS) has updated the optional standard mileage rate in 2021 to 56 cents per mile for business travel, a decrease of 1.5 cents from 57.5 cents per mile in 2020. Independent contractors are permitted mileage deduction for select business costs accrued throughout the year. If you are self-employed and use your vehicle for both personal and professional use, these expenses can add up quickly.

You Might Also Like

-

Hania Ashfaq Min

Лучшие гэмблинг-платформы с привлекательными предложениями

-

Hania Ashfaq Min

Безопасное интернет-казино с мгновенными выплатами и премиями.

-

Kashuf Huda Min

Обзор игры Sizzling Hot: экспертное мнение

-

Hania Ashfaq Min

Обзор пенальти казино: опыт 15 лет игры в онлайн казино и слоты

-

Kashuf Huda Min

Обзор казино онлайн: опытный игрок делится советами